Managing money is a big part of adult life, and most people want to do it better. There are many tips, tools, and tricks out there to help you handle your finances, but one of the most popular methods is the 50-30-20 rule. It’s simple, easy to remember, and has helped many people start budgeting. But is it really the best method for everyone? Can one rule work for people with different incomes, lifestyles, and responsibilities?

In this article, we’ll explore what the 50-30-20 rule is, where it works well, where it falls short, and how you can adjust it to fit your life. We’ll also look at real-life examples, alternate budgeting methods, and tips for building a budget that truly works for you.

What Is the 50-30-20 Rule?

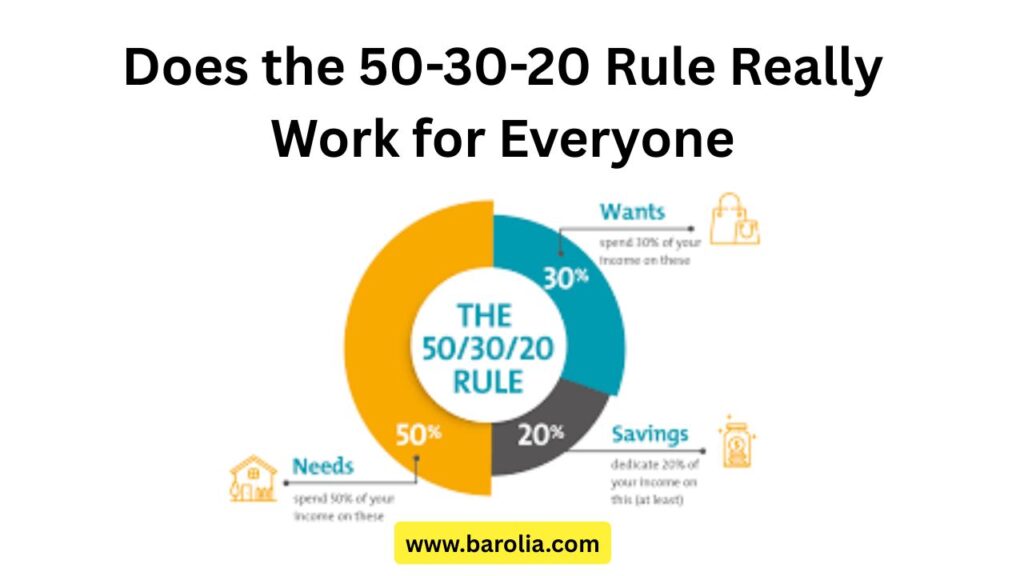

The 50-30-20 rule is a way to divide your monthly income into three basic categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings or Debt Repayment

It’s a budgeting rule that helps people make sure they’re not spending too much on things they don’t need and that they’re setting money aside for the future.

Let’s look at each part in more detail.

1. 50% for Needs

This includes the things you absolutely must pay for to live and work. These are essential items, such as:

- Rent or mortgage

- Utilities (electricity, water, gas)

- Groceries

- Transportation (fuel, public transport)

- Healthcare and insurance

- School or childcare expenses

These expenses keep your life running. They are non-negotiable.

2. 30% for Wants

Wants are non-essential items that you enjoy or choose to spend money on. Examples include:

- Eating out

- Subscriptions (Netflix, Spotify)

- Hobbies or entertainment

- Travel and vacations

- Shopping for clothes beyond the basics

- Gym memberships or salon visits

These are not bad or wasteful — they make life fun. But they’re optional, and you can cut them back if needed.

3. 20% for Savings and Debt

This part is for your future and your financial stability. It includes:

- Emergency fund

- Retirement fund

- Investments

- Extra payments on loans or credit card debt

This portion helps you grow your wealth and protect yourself from sudden expenses.

Why Is the 50-30-20 Rule So Popular?

There are a few reasons people like this method:

- It’s simple: You don’t need to be a finance expert to use it.

- It’s structured: You have a plan, which helps reduce money stress.

- It’s balanced: It allows spending on fun while still saving.

- It builds discipline: Over time, it teaches better spending habits.

Especially for beginners, this rule can be a good starting point.

But… Does It Really Work for Everyone?

The short answer: not always.

While the rule is helpful, it may not suit everyone’s life. Here’s why:

1. Different Income Levels

Someone earning ₹15,000 per month might find that 50% (₹7,500) isn’t enough to cover all their basic needs like rent, groceries, and transportation. On the other hand, someone earning ₹2,00,000 may find 50% too much for needs.

2. Location Matters

In big cities like Mumbai, Bengaluru, or Delhi, rent and daily expenses are much higher than in smaller towns. People often spend 60–70% of their income on just rent and transport. In this case, 50% for needs may not be realistic.

3. Family Size and Responsibilities

A person living alone can manage on less. But someone supporting a family, paying for children’s education, or taking care of elderly parents will have higher needs. A fixed 50% may not work.

4. Existing Debt

If you have loans or credit card debt, 20% may not be enough to pay them off quickly. You might need to use a larger part of your income to reduce debt and save on interest.

5. Personal Goals

Some people want to save for a house in 5 years. Others want to travel the world. These goals need flexible budgeting. A fixed 50-30-20 might not help reach those goals fast enough.

Real-Life Examples

Let’s break down two examples to understand the reality better:

Example 1: Ravi (Single, Lives in Delhi, Monthly Salary ₹50,000)

- Rent: ₹15,000

- Groceries: ₹6,000

- Transport & Bills: ₹4,000

- Total Needs = ₹25,000 (50%)

- Wants (dining, gym, Netflix): ₹10,000 (20%)

- Savings: ₹15,000 (30%)

Here, Ravi is able to follow the rule closely and even save a bit more. It works for him.

Example 2: Meena (Married, Two Kids, Monthly Income ₹60,000)

- Rent: ₹20,000

- School fees: ₹8,000

- Groceries & Utilities: ₹12,000

- Total Needs = ₹40,000 (67%)

- Wants: ₹8,000 (13%)

- Savings: ₹12,000 (20%)

In this case, needs are higher because of children and family responsibilities. She adjusts wants to save a decent amount.

When the 50-30-20 Rule Doesn’t Work

There are clear signs when this rule may not be right for you:

- You can’t cover basic expenses within 50% of your income

- You have zero savings at the end of the month

- You have high-interest debt that needs faster repayment

- You feel restricted or anxious about your money plan

If any of these are true, it’s time to change the approach.

Flexible Alternatives to the 50-30-20 Rule

You can adjust the percentages to suit your needs. Here are a few examples:

1. 60-20-20 Rule

- 60% Needs

- 20% Wants

- 20% Savings

Good for people in high-cost cities or families with more responsibilities.

2. 70-20-10 Rule

- 70% Needs

- 20% Wants

- 10% Savings

Useful for people with low income where survival is the priority.

3. 40-30-30 Rule

- 40% Needs

- 30% Wants

- 30% Savings

Great for people who want to save more aggressively for short-term or long-term goals.

4. 50-20-30 Rule

Flip wants and savings. Save more, spend less on fun.

Choose what works best for you.

Tips to Make Any Budget Work

Whether you follow 50-30-20 or your own rule, these tips will help:

1. Track Every Expense

Use an app or notebook. Know where your money is going every day.

2. Review Monthly

Life changes. So should your budget. Review it every month and make changes if needed.

3. Set Clear Goals

Want to save ₹1 lakh this year? Break it into monthly targets. Clear goals help you stay focused.

4. Build an Emergency Fund

Save at least 3–6 months of expenses for emergencies like job loss or illness.

5. Cut Wants, Not Joy

Find free or cheaper ways to enjoy life — a walk in the park instead of the mall, homemade coffee instead of café coffee.

Common Mistakes to Avoid

1. Ignoring Irregular Expenses

Annual expenses like school fees or insurance can ruin your monthly plan if not planned for. Set aside some money every month for such costs.

2. Using Credit Cards for Wants

Swiping now and paying later can break your budget. It often leads to high-interest debt.

3. Not Saving Early

Start saving, even if it’s just ₹500 a month. Time and habit are more important than the amount.

Final Thoughts: One Rule Doesn’t Fit All

The 50-30-20 rule is not a magic formula. It’s just a helpful starting point. Everyone’s financial situation is different. Income, rent, family size, goals, city—you need to build a budget that works for your life.

So don’t feel bad if the 50-30-20 rule doesn’t fit. The best budget is the one you can follow, understand, and adjust. Stay consistent, be patient, and keep learning. With time, money management becomes easier.